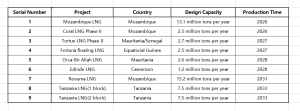

Approved projects under construction

Conducive to the diversification of natural gas supply in Europe

According to the forecast of Wood Mackenzie, the existing LNG projects in Africa may experience a situation of “first rising and then falling” before 2030.

Among them, in Algeria, recoverable reserves of natural gas were recently discovered in the Sahara Desert near the Hassi Rumel oil and gas field. It is planned to form a production scale of nearly 10 million cubic meters per day by the end of 2022, which will promote the country’s LNG export volume in 2025. However, the slow progress in the development of gas fields such as Ain Tsila may lead to a significant decrease in Algeria’s LNG exports after 2025.

In Egypt, although the imported pipeline natural gas from Israel’s Tamar and Leviathan gas fields will maintain a small increase in Egyptian LNG exports before 2025, with the rapid growth of the country’s domestic natural gas consumption in the next few years, it is expected that after 2025 Egypt’s LNG exports will also be significantly reduced.

However, the approval of three new projects in Africa before 2022 will significantly increase the region’s LNG production capacity and natural gas export capacity to Europe. Among them, Eni’s Coral floating LNG project near the northern waters of Mozambique is expected to officially deliver production in the fourth quarter of this year. The project’s production capacity is 3.4 million tons per year. A deep-water floating LNG project; the first phase of the Tortue floating LNG project jointly developed by companies such as BP and Cosmos at the maritime junction of Mauritania and Senegal is expected to be completed and put into operation in 2023, and will also bring 2.45 million tons/year Annual production capacity scale; the seventh liquefaction production line of the Nigerian LNG project jointly invested by the Nigerian National Petroleum Corporation, Eni, Total, Shell and other international oil giants is expected to be put into operation after 2026, with a production capacity of 7.7 million tons per year After being put into operation, the country’s annual LNG production capacity will increase by 35% to 30 million tons per year.

In addition, Eni’s acquisition of the Tango floating LNG project in Congo has further enhanced the LNG production capacity in Africa. In August this year, Eni announced the acquisition of the Congo Tango floating LNG project from Belgium’s Exmar, making it an important part of Eni’s natural gas development project in the shallow water block of Marine XII in Congo, and increasing the LNG production capacity in Africa by about 200 square meters 10,000 tons/year. On the one hand, Eni and the Congolese government reached an agreement on the financial and taxation clauses of the project operation design, and agreed to speed up the development of the LNG project; Advance the commissioning date of the floating LNG project to 2023. After completion, it will partially increase the LNG export capacity to Europe.

Medium and long-term natural gas in Africa

Export Growth Has Great Potential

LNG export

First of all, Mauritania and Senegal have good potential for stable export of LNG to Europe in the future. On the one hand, Mauritania and Senegal have a stable political situation and a good momentum of economic development in recent years; on the other hand, the two countries have a total of about 1.42 trillion cubic meters of deepwater natural gas reserves in the western waters, and deepwater gas fields such as Yakaar-Teranga and Bir Allah It has a good reserve scale and is relatively close to Europe.

In this area, the second phase of Tortue, which is planned to be expanded by BP and its partner Kosmos, will still be a floating LNG project, which is expected to start construction in 2027 with a design capacity of 2.7 million tons per year; the planned new Orca- The Bir Allah floating LNG project is expected to start construction in 2028, with a designed production capacity of 2.6 million tons per year, and the main supply direction is the European market.

Secondly, the proposed new LNG projects in the Gulf of Guinea and Mozambique have certain development potential. The upper reaches of the Gulf of Guinea are rich in natural gas resources. Currently, there is an Equatorial Guinea LNG project in operation, with a production capacity of about 4.1 million tons per year. Affected by factors such as the demand for natural gas in the European market and the expected rise in international LNG prices, some LNG projects in the Gulf of Guinea region that have progressed slowly due to unrealized upstream natural gas resources and investment may accelerate their progress in the future. Among them, the Fortuna floating LNG project in Equatorial Guinea is scheduled to start construction in 2027, with a designed production capacity of 2.5 million tons per year; the Edinde LNG project in Cameroon is scheduled to start construction in 2028, with a designed production capacity of 1.2 million tons per year.

Mozambique is expected to build three new LNG projects. Among them, the second phase of the Coral project has a designed production capacity of 2.5 million tons per year, and will still adopt the floating LNG development method. It is expected to be completed and put into operation in 2026; the Mozambique LNG project located in the Afonji Peninsula of Mozambique has a designed production capacity of 13.1 million tons per year , is expected to be completed and put into operation before 2026; the Rovuma LNG project has a design capacity of 15.2 million tons/year, but has not yet obtained a final investment decision, and is expected to be completed and put into operation in 2031.

In addition, Tanzania may form a large-scale new LNG production capacity after 2030. On June 11 this year, the Tanzanian government signed a framework agreement with Statoil and Shell, planning to develop two LNG projects in Lindy Province of the country. The Tanzanian government stated that the final investment decision of the above projects will be completed in 2025. Among them, Shell and its partners Medco Energy Company and Pavilion Energy Company plan to develop the Tanzania LNG (Block 1) project, Statoil and its partner ExxonMobil plan to develop the Tanzania LNG (Block 2) project, The design capacity of the two projects is the same as 7.5 million tons per year, and both are planned to be completed and put into operation around 2033.

Pipeline Gas Outlet

Against the backdrop of high and fluctuating natural gas prices in Europe at this stage, the plan of some African resource countries to export natural gas to Europe through pipelines has been put on the agenda again.

Among them, the Nigerian Federal Executive Committee approved the signing of a memorandum of understanding between the Nigerian National Petroleum Corporation and the Economic Community of West African States in June this year, planning to build a natural gas pipeline (NMGP) with a length of more than 6,000 kilometers from Nigeria to Morocco, and to use this to deliver gas to Spain. And other European countries export natural gas. The Nigerian Ministry of Petroleum Resources said the gas pipeline will pass through 15 West African countries and eventually deliver gas to Spain and Europe. At present, the NMGP pipeline project is still in the preliminary planning stage, and the construction scale, construction cost and construction timetable are not clear.

Nigeria also signed a memorandum of understanding with Niger and Algeria at the end of July this year, planning to build a trans-Saharan natural gas pipeline. The planned length of the pipeline is 3,800 kilometers, and the designed transmission scale is 30 billion cubic meters per year. It is planned to transport natural gas from Nigeria to Algeria via Niger, and finally to Italy, Spain and other European countries through the existing pipeline in Algeria.

African Gas Exports Grow

face multiple risks

The first is oil and gas geopolitical risks between resource countries and neighboring countries. Take the NMGP pipeline jointly proposed by the governments of Nigeria and Morocco as an example. The pipeline will eventually supply gas from Nigeria to Spain and other European countries. It needs to pass through 14 West African countries. It will easily become a “chip” for the relevant countries to balance geopolitics. Pipeline construction and maintenance operations are more difficult. In addition, the relationship between Algeria and Morocco has been tense recently. In August 2021, Algeria severed diplomatic relations with Morocco and closed the Maghreb gas pipeline passing through Morocco to Spain because of Morocco’s support for its own separatist forces and the territorial issue of Western Sahara. If such incidents happen again, it will seriously affect the growth of natural gas exports from Africa to Europe.

The second is the risk of natural gas demand growth in African countries. According to BP energy statistics, in the past ten years, the average annual natural gas demand growth in East Africa, Central Africa and West Africa has been as high as 10.8%, 7.5% and 8.6%, respectively, and the growth rate is at the forefront of the world; The average annual natural gas demand growth is 5.5% and 2.6%, respectively, and the consumption in 2021 has reached 45.8 billion cubic meters and 61.9 billion cubic meters respectively. The demand growth of natural gas resource countries and consuming countries in the African region will lead to the priority implementation of African natural gas supply in the region under the same economic conditions, and will also affect the export of natural gas to Europe and other regions.

Third, some LNG projects under construction and planned to be constructed face safety risks. Among them, since 2021, the “Islamic State” extremist organization has carried out multiple attacks on parts of Mozambique. Therefore, Total announced the suspension of the operation of the Mozambique LNG project with a design capacity of 13.1 million tons per year on the Afonji Peninsula of the country. resumption of production. In 2021, there will be large-scale oil theft activities of up to nearly 500,000 barrels per day in the area near the Niger Delta, which will lead to the stagnation of production in some oil fields, which in turn will lead to a reduction in the production of some associated gas, which may have a certain impact on the upstream natural gas supply of some LNG and other projects In the region .

Fourth, development costs and business operation risks. Taking the two LNG projects in Tanzania as an example, on the one hand, the upstream gas source of the project is an offshore deep-water natural gas development block, which is far away from the onshore liquefaction production line, and the cost of natural gas development and transportation is relatively high, which will have a greater impact on project revenue On the other hand, the two LNG projects in Tanzania are only 120 kilometers away from the LNG project in Mozambique, and there are multiple LNG projects with large production capacity and similar export target markets within a small range, which may pose risks in business operations .

The fifth is the risk of energy transition in Europe. From a short-term perspective, the European Union’s “Joint Action on Cheap, Safe and Sustainable Energy in Europe” proposed by the EU plans to reduce the excessive dependence on a single source of imported oil and gas through diversification of natural gas imports; in the medium and long term, it is expected that European countries will surely Accelerate the transformation and development of new energy, and further consolidate its ambition to achieve the goal of “carbon neutrality” while getting rid of dependence on imported fossil energy from a single source. Due to the relatively long period of construction and investment recovery of natural gas pipelines and LNG projects, once a breakthrough is made in energy transformation in Europe, the consumption demand for natural gas will be greatly reduced. Construction project investment decisions have a greater impact.