After entering 2022, the geopolitical risk of oil and gas between Russia and Ukraine and between Russia and Europe has continued to deteriorate, causing the “Beixi No. 2” natural gas pipeline to run aground, and the “Beixi No. 1” pipeline to be suspended indefinitely due to an explosion in the Baltic Sea at the end of September. At the critical stage of the transition to “de-fossil energy” in Europe’s local energy production, the stability of imported pipeline gas supply has declined significantly, driving European gas prices to continue to run at a high level.

In order to make up for the shortage of imported pipeline gas from Russia, Europe has to increase its supply level by procuring LNG on a global scale. In this context, the African region, which has a relatively reasonable geographical distance from Europe, good natural gas resource endowment, and frequent major discoveries in recent years, may have a good potential to increase natural gas supply to Europe in the future.

Africa is an important source of natural gas supply to Europe at the present stage

Natural gas resource endowment in Africa is relatively good. According to the 2022 edition of BP energy statistics, the proven reserves of natural gas in the region are approximately 12.9 trillion cubic meters, slightly lower than the 15.2 trillion cubic meters in North America, but significantly higher than the 3.2 trillion cubic meters in Europe.

In addition, restricted by factors such as economic development level and geopolitics, compared with the Middle East and North America, the degree of oil and gas exploration in Africa is relatively low, especially in the northern desert and the waters around Africa.

From the point of view of production and export volume

In 2021, the natural gas production in Africa will be 257.5 billion cubic meters, and the consumption will be 164.4 billion cubic meters. Natural gas production is mainly distributed in countries such as Algeria, Egypt, Libya and Nigeria.

From the perspective of export, the total natural gas exports in Africa in 2021 will be 96.5 billion cubic meters, of which the total pipeline natural gas exports will be 38 billion cubic meters, and the natural gas exports to Europe will be 37.2 billion cubic meters, an increase of 48.1% compared with 2020; LNG The total export volume is 58.5 billion cubic meters, and the export volume of natural gas to Europe in 2021 will be 32.7 billion cubic meters, an increase of 1.1 billion cubic meters compared with 2020.

From an infrastructure point of view

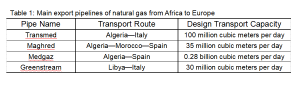

In terms of natural gas pipelines, there are already four natural gas pipelines in Africa leading from North Africa to Europe, including the two pipelines Maghreb and Medgaz from Algeria to Spain, the Transmed pipeline from Algeria to Italy, and the Greenstream from Libya to Italy Pipelines, with a total transportation capacity of about 193 million cubic meters per day.

However, from the perspective of pipeline load rate, none of the above four pipelines will operate at full capacity in 2021. Among them, the load rate of the Transmed pipeline with the largest design delivery capacity is less than 60%, and the load rate of the Maghreb and Greenstream pipelines are both below 50%. Only the Medgaz pipeline is running close to full capacity. According to information disclosed by Eni, it has recently signed a gas supply agreement with a delivery scale of about 25 million cubic meters per day, and plans to increase the delivery of natural gas to Europe through the Transmed pipeline between 2023 and 2024, which will further increase the utilization rate of the pipeline .

LNG processing capacity

As of the first half of 2022, six countries in Africa, Algeria, Egypt, Nigeria, Equatorial Guinea, Angola and Cameroon, have LNG export projects in production, with a total liquefaction processing capacity of 67 million tons per year, and Europe is also the main direction of their processing and export one.