On June 20, PetroChina and Qatar Energy signed a cooperation document on the North Gas Field Expansion Project in Doha, the capital of Qatar. According to the agreement between the two parties, Qatar Energy Company will continue to supply 4 million tons of LNG resources per year to PetroChina in the next 27 years, and transfer 1.25% of the shares of the North Gas Field Expansion Project to PetroChina.

In recent years, the natural gas industry in the Middle East has developed steadily. In 2022, Qatar will surpass Australia with an export volume of 80 million tons of LNG and become the world’s largest LNG exporter. In the future, natural gas production in the Middle East will continue to grow, reaching 86 billion cubic feet per day by 2030, which may have a significant impact on the global natural gas market.

Slow development of the natural gas industry

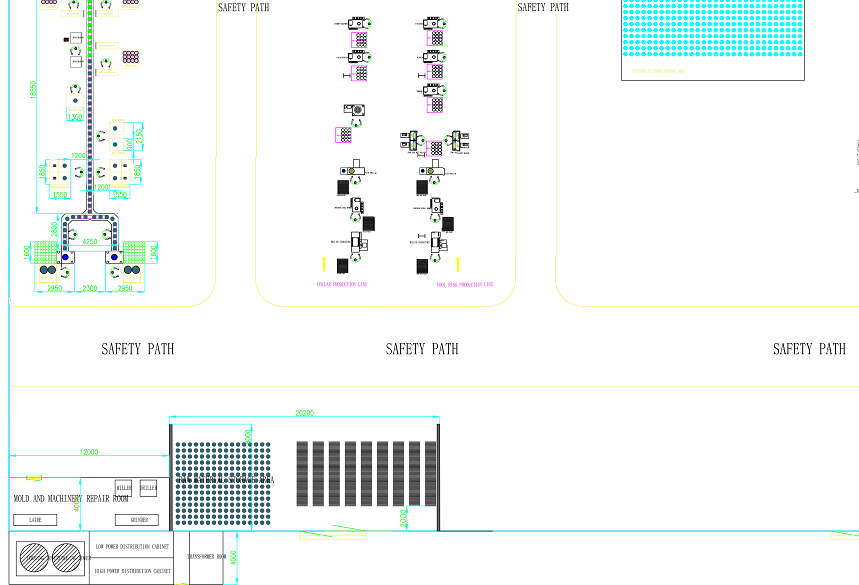

The background of the agreement between Qatar Energy and PetroChina is that Qatar is substantially expanding the production capacity of its northern gas fields. The northern gas field is the largest gas field in the world. The gas field expansion project includes gas field development and four LNG production lines with an annual production capacity of 8 million tons. After completion and operation, the annual LNG production capacity will increase by 32 million tons. Qatar aims to achieve 110 million tons/year of LNG production capacity by 2027.

Pipeline natural gas, a commodity vulnerable to geopolitical conflicts, suffered supply disruptions following the outbreak of conflict between Russia and Ukraine last February. Europe “seeks far away” and rushes to buy natural gas around the world, and the United States, which has the most new LNG production capacity, has become the biggest beneficiary. The Middle East, which has a major influence on the global oil market, is powerless in LNG spot supply. Qatar, the only major LNG exporter in the region, favors long-term LNG deals linked to oil prices, with a time span of more than 20 years and no resale to third countries.

Prior to the 21st century, associated natural gas was viewed as a useless by-product in the Middle East and was often directly flared. The natural gas markets in Middle Eastern countries are underdeveloped, and there is no way to export natural gas. Therefore, there is basically no motivation to develop gas fields.

However, the natural gas industry in the Middle East has obvious advantages as a latecomer. As the global energy transition is steadily progressing, the growth rate of natural gas production in the Middle East is now twice the growth rate of demand in the region. Qatar, the most successful transformation of the oil-producing countries in the Middle East, has become the world’s largest LNG exporter. Other oil-producing countries in the Middle East face challenges in catching up with Qatar in the development of natural gas. For example, Saudi Arabia will have to face the gap in resource endowment, and Iran will not be able to develop abundant natural gas resources due to sanctions.

The gas industry in the Middle East is indeed developing slowly. Shell discovered the northern gas field in 1971, but it believed that the gas field had no commercial value and revoked the development license. Until 1977, Abu Dhabi National Oil Company (ADNOC) built the Das Island (Das Island) LNG receiving terminal, becoming the pioneer of the natural gas industry in the Middle East. Saudi Aramco began building the Master gas system in the 1970s, and it became fully operational in 1982. By the turn of the century, natural gas production in the entire Middle East was only 18 billion cubic feet per day.

Qatar leads output growth

After the 21st century, the situation changed rapidly. Governments in the Middle East realize that low-cost natural gas can replace liquid fuels in the power sector and industry, freeing up more oil for export. At the same time, global LNG demand is also growing rapidly.

Countries have invested heavily in expanding and upgrading domestic natural gas pipeline networks. Saudi Arabia continued to expand the Master natural gas system, and built the Hawiyah natural gas plant in 2001, which was the first plant in Saudi Arabia to process non-associated gas. Qatar and Oman have also started building LNG trains. The first three production lines in Qatar were put into operation between 1996 and 1999, and the initial annual production capacity of each production line was 2.2 million tons. The Oman LNG production line was put into operation in 2000.

In 2022, the natural gas production in the Middle East will be 72 billion cubic feet per day, and Qatar’s LNG export volume will reach 80 million tons per year. In the future, natural gas production in the Middle East will continue to grow.

Considering Russia’s loss of gas market share in Europe, Middle Eastern gas presents an excellent opportunity for growth. About half of the estimated 14 Bcf/d of gas supply growth in the Middle East to 2030 will be used for LNG exports and the other half to meet rising domestic demand.

Qatar enjoys the lowest natural gas production cost in the world and has the strongest comprehensive competitiveness in the Middle East natural gas industry. It is regarded by international oil companies as the pearl of the Middle East natural gas field. Qatar is actively planning to continue to seize the window of natural gas development, establish close ties with global energy industry stakeholders, and strengthen its position as the leader of the Middle East natural gas industry. All equity partnerships in the northern gas field expansion project will last for 27 years, until 2049.

Although the United States has become the world’s largest LNG exporter for several consecutive months in 2022, Qatar is the world’s largest LNG exporter for the whole year.

In recent years, Qatar has been planning to develop the world’s largest natural gas field, the North Gas Field, in order to consolidate its position in the field of LNG exports. In addition to the two major Chinese oil companies, Total Energy, Eni, ConocoPhillips, Exxon Mobil and Shell have also invested in the Qatar North Gas Field Expansion Project. The above-mentioned companies hold 6.25%, 3.125%, and 3.125%, 6.25%, and 6.25%.

Many countries speed up the development of natural gas

The UAE currently has 3 production lines on Das Island in the Gulf, with a total production capacity of 5.8 million tons per year. Like Qatar, the UAE has opened up its oil and gas assets to international investors to diversify and raise capital. In 2020, ADNOC sold a minority stake in the $20 billion Hail & Ghasha sour gas development to international companies. The company plans to build a new LNG plant, which will be built in Fujairah, United Arab Emirates, on the southern coast of the Persian Gulf, with an annual output of up to 9.6 million tons. The company is also currently increasing the number of LNG carriers and is buying 2 new LNG carriers from China. The ships will be built at a shipyard in Shanghai and are expected to be delivered in 2025.

In order to increase LNG production, investment in associated natural gas projects in the Middle East and Africa will reach a record US$25 billion this year, and the cumulative amount will reach US$121 billion by 2030. These huge funds will be invested in the Qatar North Gas Field Expansion Project and the UAE Hail & Ghasha Gas Project.

In Oman, the Oman/Qalhat LNG project liquefies the natural gas produced in the central Oman natural gas block, and the total annual production and sales of LNG is about 10 million tons.

In Iraq, natural gas demand is expected to grow strongly, as Iraq urgently needs new reliable and cheap gas to meet domestic electricity needs. Iraq has been dependent on natural gas imports from Iran, which amounted to 56.6 million cubic meters per day. But as Iraqi demand grows steadily, Iran may not be able to continue to meet Iraqi gas imports.

In Saudi Arabia, domestic gas demand is also growing steadily, but supply growth is faster, due to the development of offshore conventional gas projects, especially the Fadhili gas project. In contrast, the UAE is gradually transitioning to renewable energy and its gas demand is expected to decline slightly. Gas demand in Oman’s power sector will also be significantly lower in the longer term due to its increased wind and solar power generation.

Middle East gas projects are very attractive to international oil companies. Although natural gas production accounts for only 34% of the combined production of various oil and gas operations of international oil companies in the Middle East, it creates 71% of the value, with an output value of US$122 billion (January 2023, based on 10% of net present value). The award results of the eastern expansion project and the southern expansion project of the northern gas field in 2022 show that the enthusiasm of international oil companies for investing in natural gas in the Middle East continues unabated. At present, a number of international oil companies such as ExxonMobil, Shell, Total Energy, Eni and ConocoPhillips are involved in at least one of these projects, and some companies are involved in two projects.